5 Volumes

Revolutionary War Era

The shot heard 'round the world.

Constitutional Era

American history between the Revolution and the approach of the Civil War, was dominated by the Constitutional Convention in Philadelphia in 1787. Background rumbling was from the French Revolution. The War of 1812 was merely an embarrassment.

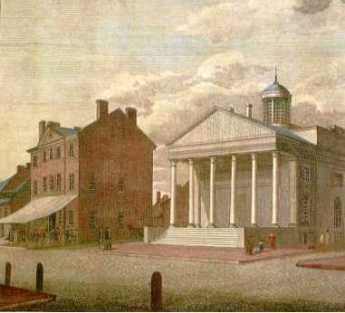

Philadephia: America's Capital, 1774-1800

The Continental Congress met in Philadelphia from 1774 to 1788. Next, the new republic had its capital here from 1790 to 1800. Thoroughly Quaker Philadelphia was in the center of the founding twenty-five years when, and where, the enduring political institutions of America emerged.

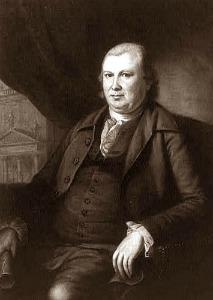

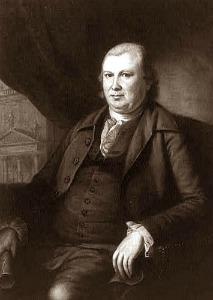

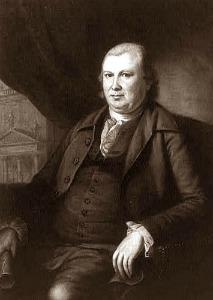

Robert Morris' United States

Robert Morris of Philadelphia created many of the best features of the United States. His face might be carved on Mount Rushmore if he hadn't created one really bad feature, as well.

Worldwide Common Currency and Corporate Headquarters

The Death of Money

Robert Morris and America

Robert Morris was an energetic problem-solver. In solving those problems he devised some innovative solutions which have become such axiomatic principles of a republic and its economics, that his name is seldom associated with them.

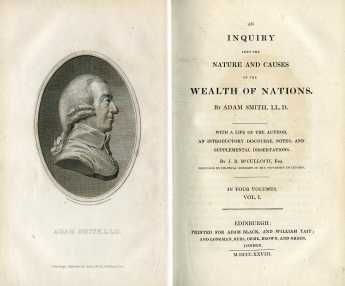

Robert Morris Invents American Banking

The finances of our new nation were subject to many violent swings from the day the British abandoned Philadelphia in 1778 right up to the end of the war in 1783, but things steadily turned for the better after Robert Morris took charge of the Department of Finance in 1780, and particularly a year later when he was given the confusing title of Financier. Those two-mile stones could be marked in another way; with the establishment of the Bank of Pennsylvania in 1780, and then a year later the Bank of North America. Both institutions were products of the Morris imagination, matching the evolving state of his thinking. But the politicians only permitted these innovations after bitter battles, so in a sense, they matched what he could accomplish politically, in two steps grudgingly forced on him by the world's reluctance to trust his ideas. It remains unclear which innovations originated with Robert Morris, and which ones were derived from the Swiss economist Jacques Necker, who had become the French Minister of Finance, or Adam Smith whose Wealth of Nations was published in 1776. There were obvious similarities in the approach of these men, and a means of communicating existed through Silas Deane in Paris. Curiously, Necker was primarily famous in Europe for shrinking the bloated and corrupt bureaucracy of French financial administration. It is not irrelevant that whenever clear thinking replaces floundering, waste and abuse begin to subside.

|

| The First Pennsylvania Bank |

The Pennsylvania Bank of 1780, unrecognizable today as a "bank", resembled a modern bond fund, operated as a partnership. It initially raised 300,000 pounds mainly from wealthy merchants, in return for interest-bearing 6-month notes. That money was promptly used to buy 500 barrels of flour for the troops at Morristown NJ. The bank thus served to transfer private funds to public purposes, which was what a rich nation urgently needs when its troops are starving.

It is always difficult to propose new ideas; in this case Morris also had to overcome resistance to taxes, which many citizens thought the Revolutionary war was all about. Taxation is, undeniably, a form of confiscation. When danger is clear at moments of panic, voluntary contributions may suffice; it is then almost sufficient to pass the hat. Soon enough, however, the government needs to increase incentives to induce the public to take the risk, hence interest rates offered by the bank must become market-driven, responding to negotiated public opinion. In short catastrophic wars for survival, a nation can gambles all its resources heedlessly. But steadily financing an eight-year war ultimately becomes a constant search for acceptable ways to transfer enough private wealth to cover the military effort, but not enough to stir up inflation. Floating interest rates, ultimately based on prevailing public opinion, do offer a match with changing prospects for victory or defeat, but only when they are not tampered with. Mismatches between public opinion and interest rates might seem tempting short-cuts to government, but they lead to inflation, price controls, rationing, and shortages of goods.

There is nothing more difficult to take in hand, more perilous to conduct, or more uncertain of success, that to take the lead in the introduction of a new order of things.

|

| Niccolo Machiavelli --The Prince |

In the United States in 1780, a huge disparity between the sudden wealth of privateers, and the abject poverty of Washington's army provoked trouble. At a time when the army was barefoot, Robert Morris' personal wealth was estimated at eight million dollars, but it seems likely the contrast between barefoot soldiers and free-spending privateer sailors was even more divisive since recruitment preferences were affected. The government tried many things: inflation default, devaluation default, confiscations, and even a few timid taxes. That duty was even proposed in Congress to be levied on the prize captures of privateers, suggests the public was alert to windfall profits. But it seemed oblivious to the principle that if you tax something, you get less of it; Congress was effectively proposing to punish the capture of British ships.

The idea of some sort of bank first came to Robert Morris less than a week after he stepped forward into the rioting streets to offer ten thousand pounds of his own money for assistance to the army, and induced several dozen of his friends to be similarly generous. It was not only necessary, but it was also nation-saving. In the previous ten months, the Continental dollar had been devalued forty to one, and then later 65 to one. No one would trust such a currency, whose consequence was certain to be a military disaster. But Morris obviously also knew that winning a war run by private subscription was unlikely to last much longer than one which depended on inflated paper currency and price controls. Petaliah Webster, a brilliant economist for the day, published pamphlets sarcastically comparing price controls to the religious conversion of a prisoner on a torture rack.

Therefore, passing the hat was also only an expedient. A week later Morris reorganized the concept to be The Pennsylvania Bank, where variable interest rates would induce reluctant lenders to lend. It was perhaps one or two steps better than losing the war, but it was primitive and limited. So, although Morris had originally opposed the war for independence, and the public certainly wasn't thrilled with taxes, market-driven interest rates were about all the Continental Congress would tolerate, as a compromise between confiscation and begging. The principle of free-market interest rates worked, in the sense that the army was able to fight on for several more years, but ultimately the soldiers revolted for lack of pay. It was notable that the Pennsylvania Line led the mutiny, or protest march, from Newburgh NY to the doors of Congress, and George Washington came close to giving the troops his tacit approval.

|

| The Bank of North America |

Well before matters came to that crisis, The Bank of North America, similarly attracting risk money by paying interest, was established in 1781 with an additional feature of generating side revenue through commercial 30-60 day loans. It was brilliant politics since Congress (with difficulty) agreed to permit a private company to engage in commerce but would never have tolerated the government doing so. When the goal is to transfer money from the private sector to the public one, the public insists on the ability to limit the amount. Otherwise, the transfer is a confiscation. Morris soon realized there was a missing third step. If the wealth of the nation was pledged to repay the war debts, creditors would insist on knowing the government's plans for repayment in case the bank couldn't do it. With the states retaining the right to tax but refusing the Federal government the right to tax without permission, the bonds of the Bank of North America were riskier for investors than they needed to be. In the difficult later years of the war, dependence on French loans began to look unwise, so the inability of the Federal government to confiscate private assets began to worry creditors. Somehow, Morris seemed to think the unratified Articles of Confederation were the problem and forced their ratification five years late. It didn't help matters, however, finally making it clear that the debt problem could not be solved without a new Constitution. When the soldiers did start to revolt, it became absolutely necessary to do something. Ultimately, the Constitutional Convention of 1787 was the result. In the meantime, the United States almost did collapse after the Battle of Yorktown (1783), and the French Revolution of 1789 is plausibly blamed in large part on our failure to repay the huge French financial support of our independence. A nation which pledges its full faith and credit behind war bonds must somehow convince its creditors that it intends to repay its bondholders, almost as fully as it intends to survive the war.

of pledging the full faith and credit of the nation through imposing taxes as lender of last resort. You don't need to pay for the whole war with loans, but you do need to reassure creditors that you will tax to repay your debts rather than default on them. That is, loan repayment is placed "ahead" of taxation. If even that structure proves inadequate, well, your war is simply not winnable because it provokes a dissolution of the government. The American public in 1781 did not need to understand the logic; it had just watched the process in grisly action. The public would not accept banks backed by federal taxation except as a wartime expedient, and therefore Robert Morris failed in his most important proposal. Although he continued to press for this essential feature for nine more years until it finally succeeded, a second near-miracle was that he kept the nation solvent in the meantime. He achieved this with a breath-taking combination of expedients, energy, ingenious fixes, and bluff. But the Treaty of Paris did not come a day too soon. In characteristic fashion, he did a quick about-face and proceeded to manage a huge personal fortune during a post-war convulsion.

In late 1779, before Morris would accept the job of rescuing the finances of the floundering new Republic, however, he meant to set some things straight. Congress must therefore first agree:

-- That Robert Morris would not accept the job unless Congress agreed that he could retain all of his private partnerships. Ben Franklin had warned him how ungrateful the public could quickly become, and what a short memory it had for those who performed favors. The Congress was infuriated by such demands, but Morris was adamant. Lucky for him that he was, because his enemies soon emerged with that age-old question, "Yes, but what have you done for us, lately? " -- That Morris has the power to dismiss any and all persons concerned with public finances and the public tender laws, for a cause. --That it was acknowledged that he assumed responsibility only for new debts, not those which preceded his taking office. -- That he has the right to delay taking the oath of office, retaining his seat in the Pennsylvania Legislature, until the relationship was clarified to give him effective control of state finances.

It can be imagined how displeased the Congress was with these high-handed stipulations, but they agreed to them.

Within three days of assuming office, -- Morris announced plans for the Bank of North America, our first true bank. -- Asked two personal friends, Thomas Lowrey, and Philip Schuyler, to buy one thousand barrels of flour on their own credit. He added, "I must also pledge myself to you, which I do most solemnly as an Officer of the Public. But lest you like some others believe more in private than in public credit I hereby pledge myself to pay you the cost and charges of the flour in hard money." -- Argued eleven points against the issuance of more paper money, particularly its requirement to be accepted as legal tender: "Because the value of money and particularly of paper money, depends upon the public confidence, and where that is wanting, laws cannot support it, and much less penal laws. . . Penalties on not receiving paper money must from the nature of the thing be either unnecessary or unjust. If the paper is of full value, it will pass current without such penalties, and if it is not of full value, compelling the acceptance of it is iniquitous." -- Arranged for the sale of western lands, to raise money. -- Acknowledged the Army was owed its back pay. -- Changed the War, Marine, Treasury, Foreign Affairs from committees of Congress to permanent departments.

Limits of Leverage

|

| Continental Congress |

PHILADELPHIA was the seat of the Continental Congress, hence the nation's capital, from 1774 to 1790, with two periods of abandonment. After the ratification of the Articles of Confederation in 1781, it became the Confederation Congress. When the British had occupied the city in 1777-78, "the Congress" fled to Baltimore, then to York, Pennsylvania, but returned as soon as the British left. The second period of the flight was occasioned by the near-mutiny of the Pennsylvania Line for lack of pay in 1783, when Congress fled, in succession, to Annapolis, Trenton, Princeton, and New York, leaving General Washington's loyalties torn between sympathy for his starving troops, and firm loyalty to law and order. The chaotic situation suited the British, who dragged out peace negotiations after the Battle of Yorktown and came close to winning by stalling what they had been unable to achieve by arms. The finances of the French government were already stretched beyond what was prudent in view of their intention to invade the British Isles. The much more solvent British began to see India as a more attractive colony than America, particularly if the lucrative trade with Jamaica and other Caribbean islands could be maintained without the expenses of the rebellion. Eight years is a long time for any nation to continue a war without generating significant unrest at home.

The Constitution did not change taxation much; it changed the people who control our borrowing.

|

|

| Revolutionary War |

So, although the Revolutionary War was primarily started by British bungling which incited intemperate colonial hotheads into rash behavior, it was going to require a new Constitution and a realistic agreement about everybody's future, to achieve a workable peace. At the beginning of hostilities, only Robert Morris and John Dickinson talked as though they had done some clear long-term thinking, and they both opposed declaring Independence. They were shouted down and forced to go along or be banished. After eight years of fighting, however, a great many people could see that Dickinson may have been right to question the dubious unity of thirteen colonies, while a smaller group could even see that Morris might have been right to focus on Constitutional Liberty rather than regime change. Washington, although he was afraid of little else was fearful about his lack of education beyond grammar school; but at least he knew a country which would not feed its soldiers must be doomed to be no country at all. James Madison was scholarly and knew about Constitutions back to Aristotle, although events proved he had offered himself as a constitutional technician without clear personal goals for the product. Alexander Hamilton and Gouverneur Morris were adventurers, quite willing to shrug off the slogans of war and establish a king, that one form of government they were sure was workable. Only Benjamin Franklin among the colonists had stood before five kings, and of course before Vergennes and Wedderburn, where he could observe that all forms of government were in the hands of agents and intermediaries. But Robert Morris was a businessman who probably wanted little more than a workable set of rules, a level playing field, where he had every confidence that he would win, regardless of other rules for the game. Those rules at a minimum must include an equitable means for the government to pay its debts. As the richest delegate, in his own city, he was encouraged to act as a host for the convention. As host, he felt constrained to speak only about finance, his main concern anyway. Once this point was established fairly early at the Constitutional Convention, Morris had little else to say, even though he personally had many irons in the fire. Everything else, as politicians say, was for sale. Besides which he was accompanied by his personal lawyer but no relation, Gouverneur Morris, who was by far the most elegant speaker and persuasive advocate in the group.

Or perhaps the true flavor of his approach was, One Thing at a Time. Robert Morris was elected U.S. Senator from Pennsylvania in the first Congress under the new Constitution. He was in the center of almost every major debate, member of more than forty committees, often described as running on and off the floor, marshaling votes. The assumption of state Revolutionary War debts was perhaps part of his central drive to establish the full faith and credit of the United States. But the location of the new capital was quite a separate issue. Morris had bought huge acreage across Delaware from Trenton, in the area now known as Morrisville, and he lobbied hard and long to have the Capital located in Trenton, just as Senator Maclay lobbied to have it settle on his own land near Harrisburg. The New York congressional delegation, led by Alexander Hamilton, fought for a New York location, although Gouverneur Morris attempted to favor his own estate, Morrisania, in the Bronx. And of course, it was the Virginia delegation which finally won the prize, on the Potomac opposite George Washington's estate at Mt. Vernon. The location of the capital was important to Robert Morris, but as a realist, he then bought up large tracts of land in the District of Columbia. Owning two sites for a national capital at the same time was a major overextension of Morris' debts which helped lead to his final bankruptcy, although he was involved in so many affairs it is hard to say which was most significant. And indeed, his lobbying from debtors prison was the main source of a new bankruptcy law, which released him from prison. When Morris was seated in the Constitutional Convention, a large number of ideas must have been running through his head. But as far as we can tell, he largely held his peace, apparently content with the significant achievement of establishing federal taxation. Robert Morris had more ideas than anybody, and more energy than was good for him.

Over the centuries, the Constitution has been seen as a marvel of concise prose. Events have reversed the position of the political parties many times, but the Constitution does not change, so much as its meaning evolves. In the case of the federal ability to tax, however, almost nothing matches its malleability. The Revolutionary War was begun in large part because of a two-cent tax on tea, which was in fact a lowering of the tax rate. By the time of the Presidency of James Monroe, the federal debt had been extinguished by national prosperity. By the time of the Presidency of Barack Obama, the economy of the whole world, not just this one nation, is threatened by excessive indebtedness. The brilliant insights of Morris and Alexander Hamilton thus leveraged the industrial world into a situation which was unimaginable in the Eighteenth century. We are today nearly forced into economic recession, in order to pay down the national debt which computers concealed from us. If our creditors lose the faith we can reduce the debt, they will raise interest rates beyond the point where even the present debt can be sustained. The Constitution did not change taxation much; it changed the people who control our borrowing. The borrower is on a long leash, but creditors hold the other end of it.

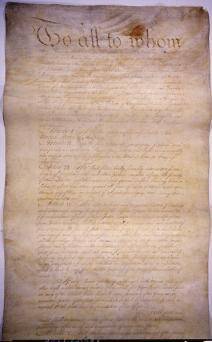

Tax References in the 1787 Constitution: Article 1, Section 2: Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons. Section. 7. All Bills for raising Revenue shall originate in the House of Representatives, but the Senate may propose or concur with Amendments as on other Bills. Section. 8. The Congress shall have Power To lay and collect Taxes, Duties, Imposts, and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts, and Excises shall be uniform throughout the United States; To borrow Money on the credit of the United States; To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes; To establish a uniform Rule of Naturalization, and uniform Laws on the subject of Bankruptcies throughout the United States; To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; To provide for the Punishment of counterfeiting the Securities and current Coin of the United States; To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers, and all other Powers vested by this Constitution in the Government of the United States, or in any Department or Officer thereof. Section. 9. The Migration or Importation of such Persons as any of the States now existing shall think proper to admit, shall not be prohibited by the Congress prior to the Year one thousand eight hundred and eight, but a Tax or duty may be imposed on such Importation, not exceeding ten dollars for each Person. The Privilege of the Writ of Habeas Corpus shall not be suspended, unless when in Cases of Rebellion or Invasion the public Safety may require it. No Bill of Attainder or ex post facto Law shall be passed. No Capitation or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken. No Tax or Duty shall be laid on Articles exported from any State. No Preference shall be given by any Regulation of Commerce or Revenue to the Ports of one State over those of another; nor shall Vessels bound to, or from, one State, be obliged to enter, clear, or pay Duties in another. No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time. Section. 10. No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility. No State shall, without the Consent of the Congress, lay any Imposts or Duties on Imports or Exports, except what may be absolutely necessary for executing it's inspection Laws: and the net Produce of all Duties and Imposts, laid by any State on Imports or Exports, shall be for the Use of the Treasury of the United States; and all such Laws shall be subject to the Revision and Control of the Congress.

|

Constitutional Liberty

WITH British troops in the process of disembarking at New Brunswick, apparently intent on hanging rebels, Robert Morris and John Dickinson annoyed everybody by refusing to sign the Declaration of Independence. Both were fully engaged in the Revolution after the fighting finally got started, and Morris signed up in August 1776. Dickinson had some further reasons of his own, but Morris explained his position quite succinctly. He didn't mind being a British subject, he didn't want a new King, what he wanted was Constitutional Liberty. There is no record of his being directly confronted about this later, and thus no detailed explanation. But whatever did he mean?

|

| Iliad and the Odyssey |

Morris was of course very bright, even brilliant as a businessman. He had an astonishing memory for detail and was capable of holding his own counsel. He was a person of great daring and prodigious amounts of work. But there is very little evidence that he thought it was useful to be mysterious, or deep. So why not take him at his word, which was essentially that what mattered in a government was whether it kept its promises and allowed its citizens all possible Liberty. It did not matter whether the government had a king, or seldom mattered much who that king was. What mattered was whether it kept its promises, and for that a Constitution is useful. There is no great pleasure in being capricious and arbitrary, so a king who leaves the citizens alone is mostly the best you can ask for. It does, however, help considerably if the rules are fair, clear, and binding. Beyond that, it is unwise to go about toppling governments in the vain hope that a new one is somehow better than the old one. This is putting words into his mouth, to be sure. What he did say was he saw no advantage to getting a new government when what we wanted was Constitutional Liberty. Eleven years later, he was a personal friend of just about everyone with the power to design a new government. Washington lived in his house, or in one next door. Ben Franklin was a business partner. Gouverneur Morris was his lawyer and partner. Just about everybody else who mattered was meeting with him in secrecy for months at a time, in the Pennsylvania Statehouse. And so on.

An essential part of this puzzle of Morris' role could be that the American Constitution was very close to unique in being written out as a document, like a commercial contract. The British Constitution was unwritten at the time and continues to be unwritten today. Many other members of the British Commonwealth operate without a written constitution. And in fact, what passed as constitutions for thousands of years have been unwritten; it was the written American one which was the novelty, not the other way around. It may stretch matters a little to describe the Iliad and the Odyssey as constitutions, but they do in fact describe the system of governance of the Ancient Greeks, clarifying many axioms of their culture for which they were willing to fight and die. We are able to understand the rules for Greeks to live by from reading Homer, almost surely better than we understand the rules of American culture by reading The Federalist Papers. Modern students of geometry, for another example, are taught that all the rules of Euclidian geometry are based on a few axioms stated at its beginning. Change one of those axioms, and you make mathematics unrecognizable. Even Newton's Principia are now seen by mathematicians to be rules which apply only to our universe for certain. There may exist many other universes to which they do not apply. Axioms are themselves mostly regarded as unprovable assumptions. A Constitution, therefore, is regarded in modern times to be much the same thing as a set of mathematical axioms. With one new exception: they are written out on a piece of paper for all to see and agree to -- just like a commercial contract. It would not be surprising to discover that America's great merchant trader, Robert Morris, was horrified at the idea of depending on Vestal Virgins or Judges, or Kings, for their recollection of what the contract says. It, therefore, seems quite natural for a maritime merchant to be agitated by having the rules of British society depend on what King George III chose to emphasize or ignore. Write it down, negotiate it, then tell us what you want so we can agree to it; that's a proper way to define Constitutional Liberty and limit disputes. International maritime trade could not be conducted in any other way, because sea captains who feel abused in a foreign port can abruptly up-anchor and sail away, never to return to that port again until or unless local rules are clarified.

Unless someone discovers some relevant documents in a trunk in the attic, that's about the best conjecture to be made about the American novelty of a written constitution, and its transformative effect on the legal system of all other nations which have one. It would still be nice to know, for certain, whose idea it was.

Who Paid for the Revolutionary War?

|

| Poker Game |

There's a saying in poker circles: never play against someone with lots more money than you have. The American Revolutionary War can be thought of as just that sort of poker game. The British could afford to lose what they lost, while somewhat smaller debts were quite enough to overwhelm the French. The cost of any war is a guess because it cannot account for death and destruction it provokes. But after a few years, it could be observed the British were holding the British Empire, while the French were left with the desolation of their own revolution. The Americans held most of a continent, free and clear, in return for their sacrifices, although their physical sacrifice was the greatest of the three main war participants.

|

| Pierre Augustin Caron de Beaumarchais, |

Leaving the British aside, much of the money paid for the war passed through the hands of Robert Morris and Pierre Beaumarchais, so in one sense they paid for at least the munitions part of the war. At the time, Beaumarchais was penniless from a lawsuit, so he was a judgment proof manager of a dummy corporation, Rodriguez Hortales et Cie. The real payors were the French Government of 1 million livres, the Spanish Government of 1 million, and 1 million from several adventurous individuals. On the American side, Robert Morris was often personally responsible for defaults, as a result of the Continental currency made worthless from printing-press inflation. In a dramatic moment, Morris stepped forward and announced he and a few friends would stand behind the debts. Not only was Morris a wealthy man, but he was largely running the United States government. Among other considerations, he had a fairly good chance of inducing the government to raise taxes to pay its own debts before he would have to assume them. Many people doubted that ability, however. Even Morris' wealth would have been insufficient to carry the whole burden, so the guarantee he made must be seen as a form of default insurance or credit default swap, containing a high degree of risk. Regardless of details, if Great Britain won the war, both Morris and Beaumarchais would have been impoverished, and probably imprisoned. The main difference was that Beaumarchais was already broke.

Morris never forgot the message, that the real security backing the loans was the wealth of the North American continent. That's what America gained by winning, and that's what it would have lost if England won. If you win a war, buy real estate.

Power of the Purse

|

| Liberty Bond |

In 1917, Congress passed a law, quite possibly not understanding its full implications. From the founding of the republic until that time, Congress had approved the exact amount of each bond issue as enacted, neither more nor less. With the First Liberty Bond Act of 1917, however, Congress began to allow the administration to issue bonds as it pleased, up to some specified debt limit. Periodically since that time, as the amount in circulation approaches the debt limit, Congress raises the limit. No doubt this procedural change seemed like legislative streamlining, making it unnecessary for Congress to interrupt other activities to respond to a debt level which creeps up on its own time schedule. The overall effect of this change was significantly different, however, and probably unintentionally.

If the authorized debt limit is raised by large enough steps, it effectively amounts to Congress turning over debt decisions to the executive branch. Conversely, raising the limit only a small amount soon triggers a repeat request, which by routine becomes so inconsequential that Congress stops paying attention to it. Regardless of the size of the block grant, bulk authorization of blocks of debt results in the power of debt creation shifting toward the President. That was not what the Constitutional Convention intended.

|

| Founding Fathers |

The Founding Fathers remembered taxation as one of the main issues of the revolt from England. Whether by King or President they had no intention of permitting the Executive to tax as he pleased; the issue traced back to the Magna Charta. Nor would they permit unlimited federal borrowing to generate escape hatches which would soon enough transform into higher taxes. Taxes, therefore, must originate in the House of Representatives, and bond issues were approved one by one. Following the 1917 liberalization, it required only fifty years before unrestrained bond limits reached a point where future national debt obligations loomed beyond the easy ability to pay them off. If they were ever pronounced unpayable by the international bond market, interest rates would rise, and eventually, federal bonds would become unsalable. With Greece, Portugal, and Ireland already flirting with bankruptcy, the approaching danger seems quite understandable to the voting public.

|

| Constitutional Convention |

The issue is constrained by another barrier. The Fourteenth Amendment to the Constitution, Section Four, forbids dishonoring "the validity of the public debt of the United States, authorized by law." Enacted after the Civil War, this Amendment was intended to prevent future states or congresses from reversing the Reconstruction Acts, but it has the additional effect of preventing future Congresses from dishonoring interest and debt repayments on existing debt. The present Congress, therefore, retains the latitude to prohibit the issuance of additional debt but is forbidden from dishonoring existing debt.

This seems like a good principle to re-emphasize, entirely disregarding the merits of the TARP, the Dodd/Frank Act, or Obamacare. Indeed, restating the Constitutional intent for Congress to be chiefly responsible for taxes and debts, seems like a very good thing to do, quite regardless of whether present national debt limits ought to be raised. The 1917 Act was a mistake, probably an unconstitutional one, and should be reversed. Holding conferences in the White House about whether to issue debt raises uncertainty about whose duty it is. The responsibility belongs to the House of Representatives, and should stay there.

Robert Morris Has a Mid-Life Crisis

|

| Robert Morris |

The feudal system once consisted of Kings awarding aristocrats a title of nobility attached to a region of inhabited land, usually as a reward for military assistance. Because of this link between their wealth and their land, almost no aristocrats migrated to America, so almost no American can now claim hereditary noble descent. What developed instead was the gentry. Regardless of the often unclear sources of their wealth, it was presumed to have arisen from some ancestor's merit, and could only be inherited if it could be made to renew itself. The vast expanses of America cheapened the value of undeveloped land, so the gentry could seldom support a gentry lifestyle without additional employment of some sort. Their children went to college, an experience originally developed for training ministers, who were expected to be the nation's leaders in balance with the tradesmen, who made no secret of their own self-serving. The expectation of community leadership for the gentry outlasted its original attachment to religion, so the non-religious gentry moved about with an air of superiority which others envied but increasingly resented. The novels of Jane Austen are filled with depictions of this sort of person during a period when they were actually rapidly disappearing. The primitive financial system and the enduring mythology of the aristocracy struggled to guide the income sources of this gentry into tracts of resalable land, where they lived off dividends, profits, and rents. Rentiers. Not quite tradesmen, but not genuine aristocrats, either.

Unfortunately, the huge abundance of land in the New World soon cheapened its value to a point where it could not support a lifestyle of entitlement along with contempt for mere tradesmen. This is the explanation often offered for the virtual disappearance of the lifestyle of the Gentleman by the time of the Civil War. The situation was rescued by the invention of corporations; a single man or family no longer could supply all the capital needed to exploit the available commercial opportunities, so corporate ownership was shared with others. Ownership of shares in corporations provided a new stream of income and a new storehouse of wealth, and it also freed the gentleman from ties to a big estate of land. The Jane Austen variety of gentleman thus virtually disappeared but remained as a mythical model for the highest aspirations in the early 19th Century. Robert Morris, orphaned and illegitimate, wanted very much to be an immensely rich gentleman even though that was becoming a contradiction of terms. And although he had virtually been in charge of the whole nation during the Revolution, he wanted very much to be looked to as a leader, then defined as some variant of a theologian. Much of this ambivalence was due to his never going to college, the same guilt which haunted George Washington. Neither of them had sufficient college-educated relatives to appreciate how little college has to do with it. A great deal probably did have to do with historical animosities between Eastern and Western Pennsylvania, between Quakers and Presbyterians, between memories of lingering hatreds among Irish tribes along Ireland's northern border. And yes, between anthracite and bituminous coal. Mountains seem to foster wild behavior, and there are a lot of mountains in Central Pennsylvania.

|

| Adam Smith: Nature and Causes of The Wealth of Nations |

The outcome of these commotions, as well as others unrecognized, was highlighted by the constant difficulties Robert Morris had in the Pennsylvania legislature, contrasted with his comparative ease in both the local Philadelphia political scene and the national one. Only at the state level did it seem that everyone was against him. Particularly so were Findlay and Smilie, western Pennsylvanians who hated him for his self-made wealth but refused to acknowledge the abilities it must surely represent. Like the Lees of Virginia, they asserted the burden of proof was on him, to prove he had not stolen his wealth. After all, all tradesmen were petty cheaters, so a very rich tradesman must be a big cheater. And even setting that aside, he had an odor of sanctity, an air of superiority, which they could not abide. There was even a centrality to this matter resting on Adam Smith, who published The Wealth of Nations in 1776. Smith argued that good things grew out of vigorous competition, and definitely not from altruism. Although Morris was sufficiently taken with Smith's arguments to give copies to his friends, he would not surrender the point that wealth was not necessarily proof of merit, just because merit sometimes led to wealth. Findlay freely admitted he was opposed to the re-charter of the Bank of North America in order to promote the self-interest of western farmers. What flabbergasted Morris was to hear his motives vilified for favoring the re-charter when he owned shares of the bank. Nowadays, everyone would feel astounded if a corporate executive did not vigorously defend his company; but in those days he stood shame-faced to admit he could not possibly be a gentleman and do such a thing. He, therefore, decided to prove his honor by taking an astonishing step. One of the richest men in America sold out his business to prove to these wizened backwoodsmen that he was truly acting like a gentleman. It would be hard today to find anyone who would not describe his action as that of a damned fool.

The Third Pennamite War (1778-1784)

|

| Wyoming massacre |

And so, after the Revolution was finally over, there was a third war between Pennsylvanians and the Connecticut born settlers of the Wyoming Valley. This time, the disputes were focused on, not the land grants of King Charles but the 1771 land sales by Penn family, most of which conflicted with land sales to the Connecticut settlers by the Susquehanna Company. The Connecticut settlers felt they had paid for the land in good faith and had certainly suffered to defend it against the common enemy. The Pennsylvanians were composed of speculators (mostly in Philadelphia) and settlers (mostly Scotch-Irish from Lancaster County). Between them, these two groups easily controlled the votes in the Pennsylvania Assembly, leading to some outrageous political behavior which conferred legal justification on disgraceful vigilante behavior. For example, once the American Revolution was finally over (1783) the Decision of Trenton had given clear control to Pennsylvania, so its Assembly appointed two ruffians named Patterson and Armstrong to be commissioners in the Wyoming Valley. These two promptly gave the settlers six months to leave the land, and using a slight show of resistance as sufficient pretext, burned the buildings and scattered the inhabitants, killing a number of them. One of the weaknesses of the Articles of Confederation was thus promptly demonstrated, as well as the ensuing importance of a little-understood provision of the new (1787) Constitution . No state may now interfere in the provisions of private contracts. Those with nostalgia for states rights must overcome a heavy burden of history about what state legislatures were capable of doing in this and similar matters, in the days before the federal government was empowered to stop it.

A flood soon wiped out most of the landmarks in the Wyoming Valley, and it had to be resurveyed. Patterson, whose official letters to the Assembly denounced the Connecticut settlers as bandits, perjurers, ruffians, and a despicable herd, boasted that he had restored, to what he called his constituents, "the chief part of all the lands". The scattered settlers nevertheless began to trickle back to the Valley, and Patterson had several of them whipped with ramrods. As the settlers became more numerous, Armstrong marched a small army up from Lancaster. He pledged to the settlers on his honor as a gentleman that if both sides disarmed, he would restore order. As soon as the Connecticut group had surrendered their weapons, they were imprisoned; Patterson's soldiers were not disarmed at all and assisted the process of marching the Connecticut settlers, chained together, to prison in Easton and Sunbury. To its everlasting credit, the decent element of Pennsylvania was incensed by this disgraceful behavior; the prisoners somehow mysteriously were allowed to escape, and the Assembly was cowed by the general outrage into recalling Patterson and Armstrong. Finally, the indignation spread to New York and Massachusetts, where a strong movement developed to carve out a new state in Pennsylvania's Northeast, to put a stop to dissension which threatened the unity of the whole nation. That was a credible threat, and the Pennsylvania Assembly appeared to back down, giving titles to the settlers in what was called the "Confirming Act of 1787". Unfortunately, in what has since become almost a tradition in the Pennsylvania legislature, the law was intentionally unconstitutional. Among other things, it gave some settlers land in compensation that belonged to other settlers, violating the provision in the new Constitution against "private takings", once again displaying the superiority of the Constitution over the Articles of Confederation. It is quite clear that the legislators knew very well that after a protracted period of litigation, the courts would eventually strike this provision down, so it was safe to offer it as a compromise and take credit for being reasonable.

It is useful to remember that the Pennsylvania legislature and the Founding Fathers were meeting in the same building at 6th and Chestnut Streets, sometimes at the same moment. Books really need to be written to dramatize the contrast between the motivations and behavior of the sly, duplicitous Assembly, and the other group of men living in nearby rooming houses who had pledged their lives and sacred honor to establish and preserve democracy. To remember this curious contrast is to help understand Benjamin Franklin's disdainful remarks about parliaments and legislatures in general, not merely this one of which he had once been Majority Leader. The deliberations of the Constitutional Convention were kept a secret, allowing Franklin the latitude to point out the serious weaknesses of real-life parliamentary process, and supplying hideous examples, just next door, of what he was talking about.

A Change of Era

A maxim of the book-editor trade is "Deviate from chronology at your peril." Two events may have little to do with each other, but it always remains possible to show the earlier event had somehow affected the later one. An editor may know little about a topic, but he knows that much.

|

| Dean Donald Kagan |

In 2011, I was privileged to be a tuition-paying student at one of Yale's Directed Studies Courses. An invention of former Dean Donald Kagan, the DS courses take an important era in history and apply three conventional faculty disciplines to it at once: Philosophy, History, and Literature. For the undergraduates, courses range in chronology from Ancient Greek to the Enlightenment; so far, the alumni just get the Greeks. Judging only from the course in Ancient Greek, the unspoken thesis soon emerged that a major era experiences permanent changes in history, philosophy, and literature, but the connection between the three is often loose, requiring some pondering to make the connections firm. Aeschylus does have a connection with Plato, and Aristotle with Thucydides but it remains unclear why the connection exists. Furthermore, you can lump these things or split them; Ancient Greece fits naturally with the Roman Empire, but it can also stand alone. Therefore, although the Yale faculty tends to lump the American Revolution with The Enlightenment, a consideration of the life and times of Robert Morris, Jr. fits naturally with both the Enlightenment and the American Era, because the American part of the Enlightenment bifurcates abruptly when Morris stood in debate with William Findlay in the Pennsylvania State House in 1798 -- and lost.

|

| Robert Morris |

Morris was the richest man in America or close to it, the unofficial President of the United States in its darkest hours, the most brilliant non-academic innovator in Western Finance, the leader of American high society, the only man beside Roger Sherman to sign the Declaration of Independence, the Articles of Confederation, and the Constitution. Morris did not realize it but he was within a few months of going to jail for three years, then spending his final five years in secluded disgrace. Robert Morris was not accustomed to closing arguments, but he lost this one, concerning the wisdom of renewing the charter of the Bank of North America, the first real bank of the country. He lost an argument he should have won easily. In retrospect, the new modern American Era was beginning, and he was apparently on the wrong side of it. Politically, that is. Speaking purely of banking and finance, he was a century ahead of his time.

|

| Ancient Greek Gods |

It seemed to me and my alumni classmates that the idea of examining a historical period like the ancient Greek one in the light of three different academic disciplines, gradually assumed considerable merit. The philosophy department examined beliefs which underlay action, and the history department described what those actions turned out to mean inhuman affairs. But the literature department came far closer than either of the other two, to imparting to a reader just what it was like to be an ancient Greek. Professor Kagan seems to have a really good idea here, although it must be resource-expensive to develop, academically. Three departments of Academia have to come to some sort of agreement about the whole synthesis, an agreement which surely must not have been present at the start. It must be a process highly similar to a medical school teaching about a disease, with coordinated input from pathologists, surgeons, and internists. A nice idea, but terribly labor-intensive of labor of the highest quality. Book editors would say it is safer to stick with chronology as an organizing principle if you plan to do a lot of organizing. Nevertheless, I must express my gratitude to Yale for allowing me to be a spectator at an experiment conducted by masters of the thinking trade. Its results must be judged by standards other than the usual ones.

Morris Upended by a Nobody

THE Revolutionary War ended militarily with the Battle of Yorktown in 1781, and diplomatically with the Treaty of Paris in 1783. The careers of Washington and Franklin appeared to be complete, while the economic and financial career of Robert Morris seemed likely to stretch for decades into the future. But as matters actually turned out for these three fast friends, it was Washington who was propelled into a new political career, Franklin soon died, and Morris got himself into a career-ending mess. The financial complexity and economic power of the United States did grow massively in the next several decades, but unfortunately, Robert Morris was soon unable to exert any leadership. At the end of Washington's eight years as President, the power of the Federalists, and particularly the three men most central to it, was coming to a close. John Adams had a tempestuous single term, and then Federalism was all over.

|

| Robert Morris |

The end of the Eighteenth century marked the end of The Enlightenment and the beginning of the Industrial Revolution, accompanied by many national revolutions, not just the American one. This was a major turning point for world history. The momentum of these upheavals still continues, but it is clear that the Industrial Revolution of which the Morris banking revolution was an essential part swept the world far faster than the social and political revolution, in which he also played a pivotal role. In the banking and industrial revolution, it is universally agreed that Morris was almost always right. In the social and political world, it is conversely agreed he was quite wrong. Essentially, Morris assumed that a small minority, an aristocracy of some sort, would rule any country. Within weeks of the ratification of the new Constitution, or even somewhat in anticipation of it, America made it clear that replacing an aristocracy of inheritance with an aristocracy of merit would not satisfy the need. Morris, born illegitimate and soon an orphan, was obviously in favor of promotion based on merit. John Adams defined leadership even more narrowly; he said a gentleman was a man who went to college, and he probably meant Harvard. Nobody extended the leadership class to include Indians and slaves, but the backwoodsmen of Appalachia made it clear that power and leadership at least included them. Thomas Jefferson was the visible leader of this expansion of the franchise, but changed his mind several times. James Madison switched sides; Thomas Paine switched in the opposite direction. The leaders of Shay's Rebellion and the Whiskey Rebellion lacked coherence and consistency on this point; instead of agitating for a refined goal, they mostly seemed to be running around looking for a leader. William Findlay, on the other hand, knew what he wanted. The issue might be defined as follows: it was obvious that hereditary aristocracy was too small and too inflexible to suffice, but it was also obvious that every man a king was too inclusive. An expanded leadership class was needed, but its boundaries were indistinct and contentious. But to return to Findlay, who at least had a clear idea of what he wanted.

|

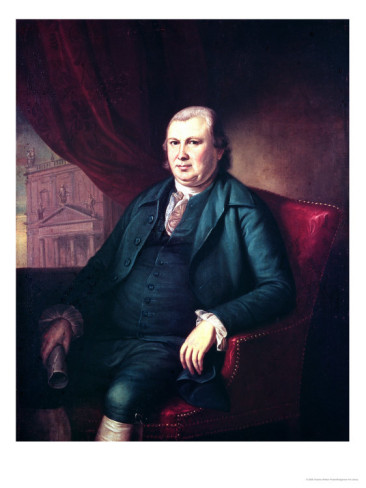

| William Findlay |

William Findlay was a member representing Western Pennsylvania in the State Legislature, in 1785. It would be difficult to claim any notable accomplishment in his life; he was largely uneducated. The new leadership class must, therefore, include both the uneducated and the mediocre. The Legislature at that time met in the State House, Independence Hall, in Philadelphia, where no doubt the unconventional dress and manners of backwoodsmen did not pass without audible comment. Findlay made his own political goals quite explicit; he was for paper money to facilitate land speculation which could make him rich. Wealth was a goal, but it did not confer distinction. The rights of the Indians, the rights of the descendants of William Penn, the rights of the educated class and the preservation of property were all just obstacles in the way of an ambitious man who had carefully studied the rules. Everybody's vote was as good as everybody else's, and if you shrewdly controlled a majority of them, you could do as you please. If this meat-ax approach had any rational justification, it lay in the essential selfishness of every single member of the Legislature, working as hard as he could to further his own interest. If someone controlled a majority of such votes, then the majority of the public were declaring in favor of the outcome. Those who believed in good government and the public interest were saps; the refinements of education mostly just created hypocritical liars. There was a strain of Calvinism in all this and a very large dose of Adam Smith's hidden hand of the marketplace. If you were rich, it was proof that God loved you, if you were poor, God must not think much of you, or He wouldn't have made you poor. Findlay had the votes and meant to become rich; if his opponents didn't have the votes, they could expect soon to be poor. In this particular case, the vote coming up was a motion to renew the charter of the Bank of North America. Findlay wanted it to die.

|

| America's first bank, the Bank of Pennsylvania |

It came down to a personal debate between Findlay, and Robert Morris. Morris had conceived and created America's first bank, the Bank of Pennsylvania. Today it would be called a bond fund, with Morris and a few of his friends put up their own money to act as leverage for loans to run the Revolutionary War. After a short time, it occurred to Morris that the money in a bank could be expanded by accepting interest-bearing public deposits and making small loans at a higher interest rate, which is the way most banks operate today. Accordingly, a new bank called the Bank of North America was chartered to serve this function, which greatly assisted in winning the Revolutionary War. There was no banking act or general law of corporations; each corporation had its individual charter, specifying what it could do and how it would be supervised. When the charter came up for renewal, Findlay saw his chance to kill it. Morris, of course, defended it, pointing out the great value to the nation of promoting commerce and maintaining a stable currency. The reply was immediate. Morris had his own money invested in the bank and only wanted to profit from it at the public expense. His protests about the good of commerce and the public interest in stable money were simply cloaking for this rich man's greed to make more money. Findlay made no secret of his interest in reverting to state-authorized paper money, which could then be used by the well-connected to buy vast lands in Ohio for speculation. There were enough other legislators present who could see welcome advantages, and by a small majority the charter was defeated.

|

| John Hancock |

At this point, Morris made a staggering mistake. After all, he was a simple man of no great background, largely uneducated but fortified by his ascent in society from waterfront apprentice to the highest of social positions, a friend of George Washington and Benjamin Franklin, acclaimed as a financial genius, the man who saved the Revolution, very likely the richest man in America. For many years, he had harbored not the slightest doubt of his personal genius, his absolute honesty, and total dedication to the welfare of his country. To have this reputation and accomplishment sneered at by a worthless backwoodsman, a man who would stoop to using the votes of other backwoodsmen to accomplish self-enrichment, was intolerable. Morris announced and actually did sell out his entire business interest as a merchant, at a moment when he fully understood the new nation was about to enjoy an unprecedented post-war boom. So much for his self-interest. It helps to understand that John Hancock and Henry Laurens had done the same thing in Boston and Charleston, against what we now see as a strange aristocratic tradition of prejudice against bankers and businessmen. In even the few shreds of aristocracy now surviving in Britain and Europe, the tradition persists that a true aristocrat is so independently wealthy that no self-interested temptations can attract him away from purest attention to the public good. The original source of this wealth was the King, who conferred high favor on those who served the nation well. A curious exception was made for wealth in the form of land, the only dependable store of tangible wealth, and transactions in land. Wealth was something which came from God and the King in return for public service. Land ownership was its tangible storage and transfer medium. Otherwise, grubbing around with trade and manufacture was beneath the dignity of a true gentleman.

|

| Henry Laurens |

We now know what was coming. Wealth was soon to be the reward of skill and merit, recognized by fellow citizens in the marketplace, by consensus. Findlay and his friends wholly accepted this conclusion, unfortunately skipping the merit part of it for several decades. In their view, you were entitled to the money if you had the votes. As the nation gradually recognized that rewards must be durable, and once granted were yours to have and to hold, the new nation gradually came to see the need for durable ownership of property. Unless or until the owner places it out at risk in the marketplace, legislative votes may not affect its ownership. Our system ever since has rested on the three pillars of meritorious effort, assessment of value by the free market, and respect for pre-existing property. That's quite a change from the Divine Right of Kings, and therefore quite enough material to keep two political parties agitated for a couple of centuries. And quite enough change to bewilder even so brilliant a victim as Robert Morris.

Two-Party Ideologies

|

| Together |

Although they try to be subtle about it, the American political parties reverse their positions fairly often on issues. Indeed, there are several times when parties reversed positions with symmetry, each taking what was formerly the other party's position. For example, the Republican Party stood in defense of protective tariffs throughout the last half of the 19th century, while in the 21st century Democrats now take the pro-tariff position, and it is Republicans who hate it. If you look for the ideological center of the parties, it is not to be found in tariffs. Nor in taxes; the Federalists, effectively predecessors of the present Republican Party largely based their whole party on rewriting the Constitution to enable the Federal government to levy taxes. But more recently it might be fair to observe they allowed George Bush (41) to lose his 1992 presidential re-election campaign because he abandoned the "No new taxes" pledge. Twenty years later, the Tea Party is still on the warpath about holding taxes down. The difference between this Tea Party and the original (Boston)one is that now the Tea Party is in the hands of rock-ribbed conservatives instead of rowdy rebels.

On the question of how many parties to have, there is fairly uniform agreement that two is best. Third parties, or splinter parties, do appear from time to time but in retrospect can mostly be viewed as steps in repositioning one or both major parties. Our system of nomination depends on the utterly pragmatic question, "Can he win?", and cheerfully dumps some candidate the leadership really likes best if he seemingly can't win. The stability of our seemingly haphazard system emerges from two eventual choices, each chosen because shrewd analysts think they have the best chance with the public. The Constitution's authors hoped there would never be any political parties, but it is arguable that the remarkable stability of our government depends on them. More ideological leadership in other countries has led to many more political parties, each held by a tighter leash. The result has surprisingly been much less stability, because each splinter party is led by someone who imagines himself a Spartan at Thermopylae, determined to and usually successful at, dying for his cause. To those less cerebral about politics, one final pragmatic argument is offered: In our two-party system, the deals are made before the election, and the public is asked to choose between two best-effort products. In a multi-party system, the deals are made after the election, often requiring several efforts to get a workable coalition. And, having already voted, the public has surrendered its control over the composition of the deal.

Ginseng Trading

DECLARATION of a state of war between Great Britain and its colonies almost immediately set loose some thinking about how to divert some of the profits and commercial arrangements of the British Empire to other owners. In particular, the American merchants began to consider how to capture colonial trade with China, or at least look into what useful gossip they could pick up in the many dealings with sea captains in port, or traders in their counting houses. The waterfront has always been a tough place, and in the seaside taverns, it can be particularly difficult to get trustworthy information or form dependable commercial alliances. So it is not entirely surprising if the captains and agents of Robert Morris found themselves in the company of many seafarers who later proved to be little short of pirates. England was conducting a lucrative trade with China, and the American colonies supplied much of the commodities. The Treaty of Paris suddenly transformed smuggling and near-piracy into open season for international trade, with much room for sharp practice.

On February 22, 1784, the Empress of China, a brand-new copper bottomed vessel built in Boston for a dubious trader named Daniel Parker, set sail from Manhattan for Canton. John Cleve Green was the captain, and ownership was a confused tangle of William Duer, John Holker, and a firm of Turnbull, Marmie, and Company which was essentially a disguised agency of Robert Morris, with Morris the dominant owner. The ship had a cargo of two commodities: 250 casks of ginseng, and twenty thousand dollars in silver. The ship would return from China a year later, bearing tea, silks, and porcelain. The world was in a post-war depression, and the numerous part owners of the venture were barely speaking to each other. But five years later it was recorded that 19 American vessels were tied up in the port of Canton. Just whose idea it was, and who gets the main credit for making it a success can be endlessly disputed, both inside and outside the courtroom. But this was in broadest outline, how the China trade began.

The rest of the story is mainly a botanical one.

Statement of Accounts, March 1785

|

| Robert Morris |

AFTER resigning his position as Financier of the United States, Robert Morris worked for five months laboriously summarizing and detailing his official activities, and then he paid for printing five hundred copies of it. The document had a five thousand word preamble and over two hundred printed pages of detailed accounts, a prodigious effort. And a rather unprecedented one in an environment of traditional national secrecy about its accounts, except for the pioneering efforts of Necker in France. His reward at first was an infuriating discovery five years later that the government had not released his report to the public, and continued throughout this time to investigate Morris's earlier activities on the Secret Committee. The standard of bookkeeping for a secret committee engaged in smuggling arms before the Declaration of Independence was understandably obscure, and to have it flogged for failing to uphold the improved standards of government accounting which Morris later devised for the new nation was such a mixture of ingratitude and slyness that the behavior seemed well beyond infuriating. Nevertheless, it must have been gratifying to end the report with a positive balance of $21,000 even after eight years of struggle, war, and improvisation. The magnitude of this achievement was not lost on others in a position to see the contrast with earlier efforts, encapsulated by James Madison whose committee report concluded, "It appears to the committee that the regular official examination has already been made, and it would be inexpedient to incur the expense of a re-examination."

Madison by this time was evolving into a political opponent of Morris, but Samuel Osgood was a declared opponent of his approach to government accounts. Osgood's assessment of his opposition to the approach was prefaced with a ringing statement of its effectiveness: "I will tell you very freely, that in mere money transactions, he has saved the United States a very large sum... I am also of the opinion that much more regularity has been introduced into the keeping of accounts than ever before existed. This is a matter in my mind of very great importance. And without the strictest attention to it, the several states ought not to trust Congress with a single farthing of their money."

|

| Samuel Osgood |

The supreme irony of this situation was that by imposing strict accounting standards where none had previously existed, Morris was offering to his enemies a club to beat him with. Instead of recognizing that Morris was both too diligent and too rich to bother with cheating, there emerged a duel in which his enemies took unusual behavior to be a sure sign of wickedness, while Morris absolutely courted personal disaster, supremely confident he was unchallengeable.

There are two enduring truths to both positions. It is absolutely true that a well-informed public has a perfect right to do anything it pleases, regardless of the existing rules of government, regardless of the opinions of predecessors, heedless of the opinions of anyone else, past present or future. If a republic has supplanted a monarchy, the republic in a sense has the same divine rights. It's just unwise to act that way in anything but extreme circumstances.

On the other hand, it is also absolutely true that stability, peace, and prosperity are most likely enhanced by avoiding the mistakes of the past, following the accepted rules of conduct, and avoiding the counsel of loud and unstable leaders. Once in a while, a genius does appear and his discoveries should be adapted for future use as rules. Once in a while, a treasured maxim needs to be discarded. In a limited way, these evolutions of the rules of the road are an application of Galileo's invention of the scientific method, applied to the Common Law by Sir Francis Bacon. Make a likely conjecture, then verify it. And the second source of societal wisdom is the constant pressure of Society's Hidden Hand, as described by Adam Smith. The American Revolution was not so much an overthrow of a boisterous king, as it was incompletely successful incorporation of existing principles into a Constitutional system of government.

|

| Galileo's invention |

Considering the convulsive upheaval caused by its principles, the 18th Century colonists must be forgiven for misjudging their situation when confronted with a genius like Robert Morris. In barely a moment of time, Morris assembled these ideas into a vastly improved system of government management, immediately proved that it made the country rich, and demonstrated that he had the common sense to make himself rich using the same ideas. Even the idea usually attributed to his friend George Washington, that honesty is the best policy, sounds more like Morris than Washington, and certainly more like Morris than Alexander Hamilton. Only the likes of John Adams protested that honesty came from God. Morris did not deny that was possible, but acted as though it was irrelevant.

Pay attention to the voice of consensus, be quick and alert to occasional innovation, and don't waste your time being crooked. With these three rules, Morris got rich and made his country rich, enraging those who do not think riches should be a universal goal. Don't want to be a millionaire? Plenty of other people will take your place.

Our two-party system began in Appalachia, and one poor soul found himself marooned there. Hugh Henry Brackenridge, a representative of Western Pennsylvania, cried out, "If they would let Mr. Morris alone, he would make Pennsylvania a great people. But they will not suffer him to do it!" Brackenridge was never elected again.

REFERENCES

| Robert Morris: Financier of the American Revolution: Robert Morris: Charles Rappleye: ISBN-10: 1416570926 | Amazon |

Morris Defends Banks From the Bank-Haters

|

| Robert Morris |

IN 1783 the Revolution was over, in 1787 the Constitution was written, but the new nation would not launch its new system of government until 1790. It was a fragile time and a chaotic one. Earlier, just after the British abandoned their wartime occupation of Philadelphia in 1778, Robert Morris had been given emergency economic powers in the national government, whereas the state legislatures were struggling to create their own models of governance, often in overlapping areas. While the Pennsylvania Legislature was still occupying the Pennsylvania State House (now called Independence Hall) in 1778, it -- the state legislature -- issued the charter for America's first true bank the Bank of North America, and in 1784 the charter came up for its first post-war renewal. Morris was a member of the Pennsylvania Assembly both times. Although he was not a notable orator, it was said of him that he seldom lost an argument he seriously wanted to win. Keeping that up for several years in a small closed room will, unfortunately, make you many enemies.

|

| Tavern and Bank |

Morris was deeply invested in the bank, in many senses. He had watched with dismay as the Legislature squandered and mismanaged the meager funds of the rebellion, issuing promissory notes with abandon and no clear sense of how to repay them, or how to match revenues with expenditures. There was rioting in the streets of Philadelphia, very nearly extinguishing the lives of Morris and other leaders, just a block from City Tavern. Inflation immediately followed, resulting in high prices and shortages as the farmers refused to accept the flimsy currency under terms of price controls. Every possible rule of careful management was ignored and promptly matched with a vivid example of what results to expect next. Acting only on his gut instincts, Robert Morris stepped forward and offered to create a private currency, backed by his personal guarantee that the Morris notes would be paid. The crisis abated somewhat, giving Morris time to devise The Pennsylvania Bank, and then after some revision the first modern bank, the Bank of North America. The BNA sold stock to some wealthy backers of which Marris himself was the largest investor, to act as last-resort capital. It then started taking deposits, making loans, and acting as a modern bank. Without making much of a point of it at the time, the Bank interjected a vital change in the rules. Instead of Congress issuing the loans and setting the interest rates as it pleased, a commercial bank of this sort confines its loans to a fraction or multiple of its deposits, and its interest rates are then set by the public through the operation of supply and demand. The difference between what the Legislatures had been doing and what a commercial bank does, lies in who sets the interest rates and who limits the loans. The Legislature had been acting as if it had the divine right of Kings; the new system treated the government like any other borrower. As it turned out, the government didn't like the new system and has never liked it since then. Today, the present system has evolved a complicated apparatus at its top called the Open Market Committee of the Federal Reserve, most of whose members are politically appointed. Several members of the House Banking Committee are even now quite vocal in their C-span denunciations of the seven members of the Open Market Committee who in rotation are elected by the commercial banks of their regions. Close your eyes and the scene becomes the same; agents of the government feel they have a right to control the rules for government borrowing, while agents of the marketplace remain certain governments will always cheat if you don't stop them. This situation has not changed in two hundred years and essentially explains why some people hate banks.

|

| Seigniorage |

That's the real essence of Morris's new idea of a bank; other advantages appeared as it operated. The law of large numbers smooths out the volatility of deposits and permits long-term loans based on short term deposits. Long-term deposits command higher loan prices than short-term ones can; higher profits result for the bank. And a highly counter-intuitive fact emerges, that making a loan effectively creates money; both the depositor and the borrower consider they own it at the same time. And finally, there is what is called seigniorage. Paper money (gold and silver "certificates") deteriorates and gets lost; the gold or silver backing it remains safe in the bank's vault, where it can be used a second time, or even many times.

For four days, Morris stood as a witness, hammering these truisms on the witless Western Pennsylvania legislators. At the end of it, scarcely one of them changed his vote, and the bank's charter was lost. But at the next election, the Federalists were swept back into the majority, defeating the opponents of the bank. Although, as we learn the way democracy works, still leaving them unconvinced of what they do not want to believe.

Tammany: Philadelphia's Gift to New York

|

| Tammany Hall |

EDWARD Hicks painted a scene over and over, depicting William Penn signing a treaty of peace with the Lenape Indians at Shackamaxon ( a little Delaware waterfront park at Beach Street and E. Columbia Ave.). This scene was apparently a reference to a larger and more finished depiction by Benjamin West. The Indian chief in the painting is Tamarind, chief of the Delaware tribe. Long before Hicks got the idea for the picture from Benjamin West, Tamarind was locally famous for having the annual celebrations of the Sons of St. Tammany named after him. These outings centered on the joys of local firewater and thus may have had something to do with the evolutions of the Mummers Parade. George Washington presided over a lively Tammany party at Valley Forge, and local Tammany Hall clubs sprang up all over the country. The most famous offshoot had its headquarters on 14th Street in New York, as a club within the local Democrat party asserting Irish dominance over New York politics, allegedly using Catholic Church connections to control other immigrant groups. The identity of Tammerend seems to have got thoroughly mixed up along the way; the famous statue of "Tecumseh" at the Naval Academy in Annapolis, much revered by the cadets, is actually a depiction of Tammany.

|

| Penn's Treaty With the Indians By Benjamin West |

At earlier times, Tammany was the vehicle Aaron Burr used to assert control of the now-Democrat Party, particularly in the contested Presidential election of 1804. Shooting Alexander Hamilton in a duel, along with disgrace and impeachment as Vice President necessitated Burr's rapid conversion into a non-person, both in New York and in Philadelphia. In Philadelphia, the uproar led to the dispersion of Tammany influence, while in New York other bosses, particularly Boss Tweed, took over the organization and consolidated its role as a small club which dominated a larger political party, which in turn pretty well took over the government of New York City, which in turn dominated the governance of New York State, and even occasionally leveraged itself into national politics. Eventually, Tammany fragmented sufficiently that Mayor Fiorello La Guardia was able to dislodge it from control, which in time led to its dissolution. In a larger sense, however, the decline of New York's Tammany Hall began when in the late 19th Century it adopted the Philadelphia system of consolidating graft from local leaders into unified "donations" from local utilities. That greatly improved the efficiency of collections and disbursements but undermined the need for an effective local organization of ward leaders.

|

| Aaron Burr |

So, although Tammany was originally a Philadelphia creation perfected by New York, it continued to have connections to Aaron Burr in early days, and Philadelphia machine politics later on. But of course for seventy-five years, around here it seemed Republican.

Funding the National Debt

|

| Alexander Hamilton |

Although Alexander Hamilton's arresting slogan that "A national debt is a national treasure" has diverted attention to the underlying idea toward him, Robert Morris had introduced and argued for the same insight in the preamble to his 1785 "Statement of Accounts". The key sentence was, "The payment of debts may indeed be expensive, but it is infinitely more expensive to withhold payment." This fatherly-sounding advice was surely a distillation of a long life as a merchant, and the gist of it may have been passed down to him as an apprentice. Failure to pay your debts promptly and cheerfully results in the world assigning a higher interest rate to your future credit; it is not long before compounded interest begins to drag you down. It doesn't exactly say that, but that's what it means.

|

| Liberty Bond |