Related Topics

Whither, Federal Reserve? (1) Before Our Crash

The Federal Reserve seems to be a big black box, containing magic. In fact, its high-wire acrobatics must not be allowed to fail. Nevertheless, it may be time to consider revising or replacing it.

Our Federal Reserve (1)

|

| Colonial Coins |

The most enduring, and bitter, controversy in American politics concerns the control of the currency. That's not unusual, since as far back as 1000 B.C. the person or group who controls any government of any country has met resistance in raising taxes, and so was tempted to coin more money. Unless you personally received a big chunk of that new coinage, you were opposed to the system, because of the inflation it invariably created. Prices go up.

So people get upset with watered currency, and once refused to consider something to be real money unless it was made of gold. Gold doesn't rust, there's only a limited amount on the planet, and everybody agrees it's pretty. Silver was maybe all right, too. Gold dust was weighed in the marketplace, but if you trusted the dust you took a risk it had been diluted with something. So coins evolved, with a picture of the king stamped on them, and the edge of the coin serrated, so cheaters would be unable to shave the coin and use the shavings. It didn't matter who stamped the coin, and throughout Colonial times in America, the Spanish piece o'weight was good as gold. But the use of gold and silver coins was cumbersome, and occasionally there were local shortages. One of the important causes of resentment leading to the American Revolution was local discontent with the way the British allowed disruptive shortages of coinage to interfere with commerce in the colonies, at the same time the British prohibited paper currency as too easy to counterfeit. Without a common medium of exchange, commerce is driven to resort to the inefficiencies of barter.

|

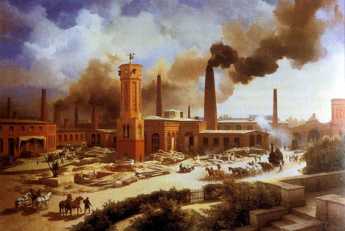

| Industrial Revolution |

So, barbarous relic or not, gold was quite effective in restraining governments from their irresistible tendency to promote inflation. The downside began to appear when the Industrial Revolution caused a great increase in a trade because a fixed amount of money in circulation will force all prices lower in a rapidly growing economy. Nobody will buy anything if everything is certain to be worthless if you wait. If people are reluctant to buy, prosperity soon comes to an end. Merchants don't like lower prices, and debtors don't like to repay their debts with money that's scarcer. People are just as unhappy as they were during inflation. Eventually, everybody came to see the best thing was price stability, neither rising nor falling. To accomplish that, the amount of money in circulation has to match the growth of the economy, technically a very difficult balancing act for the government. With the British treasury separated from the colonies by 3000 miles of ocean, and sailboats were used to communicate the distance, the whole thing became impossible.

|

| French Revolution Guillotine |

It's sort of true that an unstable currency puts rich people and poor people into contention. But the more fundamental fact is that it puts creditors and debtors in conflict, thereby paralyzing commerce and injuring everybody else. For three centuries, our political rhetoric has enlisted the support of "workers" against the "the rich", but that's only acceptable shorthand if the balance of currency has gone too far in one direction or the other, and needs to be corrected. If you really let those slogans polarize society, you won't get fairness, you will get another French Revolution and the guillotine. What's needed is to fine-tune temporary imbalances, so the amount of currency in circulation grows gradually in parallel with the economy. During nearly three centuries of struggling with this mysterious issue, we have frequently lost our way with attempts to have "free silver", with honoring or dishonoring the Continental currency, with issuing Greenbacks during the Civil War, War Bonds during various wars, deliberate national deficits during recessions, going off the gold standard, and a host of other expedients and desperate political gestures. The first person to devise a workable system of matching the money in circulation with the size of the economy, was Nicholas Biddle, of 715 Spruce Street.

Originally published: Friday, June 23, 2006; most-recently modified: Wednesday, May 29, 2019