Related Topics

Old Age, Re-designed

A grumpy analysis of future trends from a member of the Grumpy Generation.

Heads Up: Look Ahead

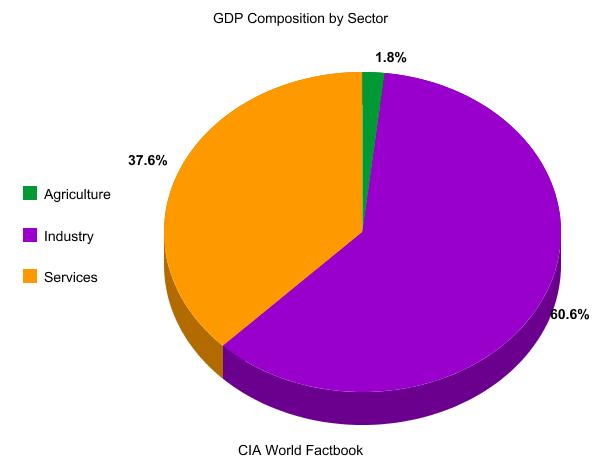

THE LIMITS OF GOVERNMENT. Most budgets appear balanced at the beginning of the year because projected revenue has been overestimated; those deficit budgets are balanced at the end of the year by borrowing the shortfall. The most efficient level of taxation has been experimentally shown to be around 18% of the Gross Domestic Product or GDP. That's essentially shorthand for the whole national economy. If government debts exceed the GDP or even grow faster than the GDP does, no one will loan that government money. It's hard to escape the logic that if federal spending levels average 18% of GDP, budgets can be ignored. There's a marginal error in the 18%; but there needs to be a margin of error, perhaps as much as 2%. Go back and read that short paragraph three times.

|

| Gross Domestic Product, |

State and local governments are different; only sovereign governments can print money. State and local can be allowed to fail, and that disciplines state and local spending. Sovereigns are limited by GDP, with overall money creation linked to it, while the public makes the leap of faith that an independent Federal Reserve will match money creation to GDP. Moreover, since entitlements like Medicare and Social Security already make up most of U.S. government spending, and will soar in a few years when the baby boomers reach retirement age, demographics make Federal predictions somewhat more precise. Raising taxes is now recognized to reduce the net value of that 18% number, while infinitely rising deficits will be blocked by the bond market, first by rising interest rates, if necessary by a boycott. Unless you just ignore the recession which will eventually be caused by soaring long-term interest rates, spending must be cut severely. Just about the only remedy left is to shift the cost of entitlements back to the private sector. By increasing private savings and drawing compound interest, some unknown amount of progress might be made on this problem. The retirement age must also be increased, second careers after retirement must be encouraged, the costs of retirement must be reduced -- and all other ideas must be explored, too. But one of the main arguments for increasing private savings is that all of the ideas anybody has suggested, rolled up in a ball, are questionably sufficient to finance the approaching problem. It will simply not be possible to evade a serious examination of any suggestion, including this one. Privatize. The public sector is just not big enough to handle the matter, and if you make the public sector bigger, you will destroy the whole economy. Privatize.

DON'T LOSE FAITH IN SCIENCE. It's the common belief that financing Social Security is not nearly as difficult as financing Medicare, but that's just the extrapolation fallacy announcing again that trends in motion will continue forever. Medicare seems to be getting more expensive for three reasons, all temporary. The costs of dying are shifting into Medicare as the population lives longer; eventually, just about everyone will live long enough to die at Medicare's expense, and terminal care costs must then stop shifting. Second, the cost of dying is going to decline as medical research turns to the engineering costs involved, separate from heroic efforts to forestall dying. No one is suggesting euthanasia; just simplifying the issues once a final decision has been made. Third, the cost of chronic illness and disability needs both curative and engineering improvements. Take rheumatoid arthritis (RA) for example.

Thousands of people are painfully crippled every year by RA. They are treated, medicated, pensioned, operated on, and provided with complicated equipment. Suddenly, some new medications have come along which promise there will be a much less further progression of RA in patients who have it; if we use them, the number of cripples will eventually decline. It has a real cost to use new medications, of course; it will cost several thousand dollars a year to offer this miracle to the rheumatoid sufferer. But when the patent protection on those miracle drugs runs out, even on the inevitably improved variants of these drugs, the cost of treatment will surely go down to a thousand or so dollars a year. Meanwhile, the backlog cost of repairing the injured joints of patients who got the disease long ago will fade away. And the engineers will figure out how to make crutches, canes and electric go-carts out of plastic or equivalently cheap ingredients. Most of those patients who now have to be pensioned will be able to find gainful employment. Maybe, maybe, someone will figure out what causes this disease and invent a simple cure for it, but it isn't necessary to pray for miracles on that level in order to predict a major decline in the cost of managing this nasty disease. It is safe to predict that other diseases will follow the same trajectory as RA, leading eventually to a resolution of the fearful costs of Medicare. Social Security is something else; if everybody lives a longer healthier life, non-physicians are going to have to figure out how to pay for living it. Wiggle and squirm all you please; call me names, call the police.

There is no solution to the cost of increased longevity, except to raise the average age of retiring from work.

Originally published: Thursday, June 22, 2006; most-recently modified: Sunday, July 21, 2019