Related Topics

Reflections on Impending Obamacare

Reform was surely needed to remove distortions imposed on medical care by its financing. The next big questions are what the Affordable Care Act really reforms; and, whether the result will be affordable for the whole nation. Here are some proposals, just in case.

Elective Hospital Admissions: Flexible Deductibles

Flexible Deductibles. Front-end deductibles are a long-standing tradition in casualty insurance, mainly popularized to accommodate automobile accident insurance. There features of health insurance, however, which are quite different from fender-benders should be suitable for appendicitis, however. Some things can only happen to a patient once, like appendectomy, or many other "-ectomies" which remove a whole organ. Some things are restricted to women, other things like prostatectomy are overwhelmingly found in old men. Because of a wish to give everybody the same benefits, particularly in industrial groups but also in other situations, these factors are ignored in setting a premium. Some subscribers are therefore deliberately and permanently overcharged. The insurance premiums could remain level (a process called "community rating") however, but some feelings of persecution could be reduced by adjusting the deductible downward for the first instance of an appendectomy, cholecystectomy or whatever. It could be seen as a reward for never coming back for that sort of thing, and therefore reducing the future costs of the program, as other diseases like pneumonia or broken legs do not. In fact, certain inherited features or a history of heavy smoking can predict increased risk for pneumonia, while "accident proneness" is well recognized in industrial circles. The spreading use of computers could make it relatively easy to see how much difference these indicators at different deductible levels actually make for future costs. If a changed deductible alters behavior, that would be fine; if not, at least the risk of a particular client group can be more accurately predicted. The result would eventually be a greater willingness to transfer insurance carriers. At the moment, there is a hidden reluctance among some patients, not unlike the other causes of "Job lock", in which beneficiaries must weigh the consequences of switching. It could also affect the pricing of secondary insurance.

|

| IDC-10 Codes |

Earlier it was stated, deductibles should apply to outpatient services, but are essentially useless to restrain inpatient costs, over which the patient has no control. That is true but misleading. If appendectomies represent 5% of all health care costs, someone's health insurance should be 5% cheaper if he has already had his appendix removed. If a hernia repair is considerably more comfortable in the hospital, someone who prefers to be in the hospital ought to pay more than someone who has it performed as an outpatient. From time to time, we read of a rich old lady who lives for several years in a hospital because she likes it there. If she is willing to pay for it, why not? She just should not be permitted to use insurance to pay for it. If the same procedure is sometimes performed for an outpatient, but occasionally requires hospitalization, that distinction can seldom be made by the diagnosis alone. Most probably, the submission of certain items of laboratory work will justify it. This point is both more subtle and more complicated than it sounds. Traditionally, insurance rules concerning elective admissions are based on diagnosis codes so insurance utilization clerks can approve them; much friction results when such decisions prove inappropriate. The diagnosis code for "status post-appendectomy" is seldom used at present, but it would make a simple vehicle for appropriate pricing incentives. The process of challenging peculiar-looking diagnoses then becomes a major cost in time and money for everyone concerned, even though deductibles purport to generate cost savings. Finally, a flood of elective admissions may itself suggest a need for all deductible amounts to be increased. It is, of course, possible to go too far with such a process, which needs to be perfected on a diagnosis level before it is extended any further. Best of all, the size and applicability of deductibles might be left to the various competing insurance firms as a competitive tool; some would do it, some wouldn't, and the customers could choose.

|

| gastric surgery |

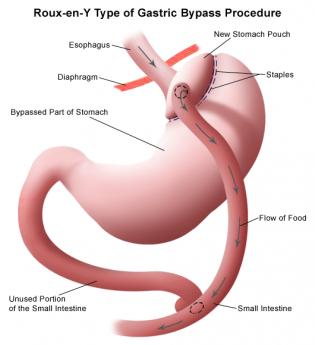

Perhaps a further useful example lies in the evolving use of gastric surgery to treat obesity. The procedure is presently characterized as more effective than any other available approach to morbid obesity of the six-hundred-pound variety. And yet patients with advanced degrees of disability from obesity often confront the surgeon with considerable extra difficulty and risk. Under those circumstances, it can be both hazardous and expensive. At the opposite end of the spectrum are neurotic patients with only minor degrees of obesity, sometimes trivial degrees, who demand what amounts to cosmetic major surgery masquerading as a treatment for gastric reflux. A fairly high deductible, particularly one buffered by a Health Savings Account, could usefully have two or three deductible plateaus matching specified features of advancement. The proposal is roughly this: the more obese the patient, the lower the deductible. The surgical treatment of obesity is a particularly illustrative example at present because recent evidence is starting to identify the avoidance or reduced cost of diabetes when it is already present. Some insurance companies may wish to take a chance on this promising development, so making a large deductible and discounting it as evidence accumulates would provide a mechanism for accomplishing that goal. The managers of other groups may offer traditional reasons for retaining community rating practices; both options can be retained by adjusting prices at the level of the deductible.

But to repeat the central point, deductibles need to be larger than they have traditionally been, to be able to leave room for the incentive of discounting them.

Originally published: Thursday, April 25, 2013; most-recently modified: Thursday, May 16, 2019