Related Topics

Reflections on Impending Obamacare

Reform was surely needed to remove distortions imposed on medical care by its financing. The next big questions are what the Affordable Care Act really reforms; and, whether the result will be affordable for the whole nation. Here are some proposals, just in case.

Foreigners Are Fed Up With Paying Our Bills.

|

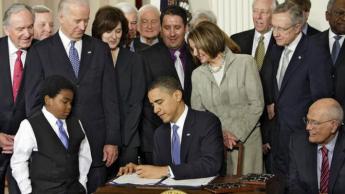

| Obama Signs Health care Bill |

Implementation of the Affordable Care Act, often called Obamacare, is about to begin, but a majority of the public express fear of it to pollsters.

Obamacare is essentially a modified version of Medicare for the younger generation, so at first it's a little hard to see why that is so threatening. Presumably, Mr. Obama is also a little puzzled by the reaction, although he has an unfortunate way of attacking anyone who disagrees with him. Can it be that he fails to see the main thing the matter with Medicare itself is its cost overrun?

The first announced preference, and now the fall-back, was a "Single Payer" system, which would simply combine the two deficits into one bigger deficit. The Affordable Care Act does indeed follow fifty years of general satisfaction with Medicare for people over age 65, because everybody enjoys a dollar for fifty cents. The main source of public uneasiness arises from a vague recognition of Medicare's unsustainable mismatch between costs and revenue, which has been pretty effectively buried in a mass of information. You might say it is in plain sight, except it really isn't plain.

Medicare is 50% subsidized by debt, so everyone gets a 50% discount from real costs, and naturally loves it. But after fifty years of off-budget borrowing, the nation now wonders if we can even keep Medicare up, let alone add another program to it. The public surely does not understand how the deficit was "overlooked", maybe doesn't even want to know. But when the debt gets so large it begins to crowd out everything else the public wants, people are not stupid, and they see it plainly. In fact, they have realized it for some time, and the elderly in particular are fearful that giving the same generosity to everyone mught eventually mean taking some of it away from them.

The small businessmen who are the main strength of the Tea Party movement, see they have been excluded from the income tax subsidy enjoyed by employees of big business for the past seventy years. They are particularly enraged by the new cost barrier to going from 49 to 50 employees, and the implicit penalty for working more than 30 hours a week. It doesn't seem fair, it shows no sign of going away, and they fear to see it extended. On the other hand, the employees of big business, just like the Medicare recipients, know very well they have been given an undeserved free ride, and are fearful it will be taken away to pay for other people.

In short, the economy is hurting, leaving no room for sprinkling goodies to everybody. America's balance of trade went negative in 1965, and has stayed negative ever since. So the crunch of borrowing from foreigners was a long time coming, but it seems to be getting to an end. It can't continue without squashing someone. Omitting the youngest and poorest of our country, just about everyone recognizes that to be true, and is uneasy about where it might lead.

Since healthcare costs are "only" 17.6% of current Gross Domestic Product (GDP), extra financing might not be required for Obamacare as long as the rest of the economy remains steady. After all, we proved you could borrow 75% for short periods, by trying it for a while during a recession. Even if the nation -- at any age -- could afford 17.6% of GDP for health, some method is still needed to share out the medical debts of those who cannot support themselves. If the upper half of the population supports the bottom half, for example, and graduated income taxes take increasing proportions off the top, it's not clear even the rich could afford 17.6% medical costs plus 74% in taxes, as the French do and some economists advocate. Especially if you double it to 35% to account for the hidden subsidy, and arrive at a total of 124% of income. So the real breaking point depends on details, but a national mandate is getting clear: Don't make things worse.

From the point of view of the non-rich, it's probably worse, because it always is. Campaign rhetoric has encouraged most people to suppose their own needs will be met, but foresee minority interests suffering to protect the interests of the majority; "crowding out" is the familiar danger during a recession. Gradually raising the present 17% -- to 18%, 19% or even higher -- suggests the frog-boiling approach of heating up the pot before the frog senses what approaches. One possible limit to public tolerance can be imagined: It is plainly unacceptable for the top 49% to pay all the costs for the bottom 51%. If "fairness" means anything like that, fairness will be discarded, and that would make a fine mess. It is clear the designers of the Affordable Care Act are disconcerted by the amount of cost-shifting they discovered was already taking place, and it does not soothe the public for Nancy Pelosi to announce we had to pass the Act to find out what was in it. To act without investigation is pretty much what happened with Medicare in 1965, so it's less likely the public will tolerate a repeat of it.

At least, don't make things worse.

|

This book does not address redistribution by social class, but by age. The "pay as you go" system practically guarantees the last one in will get the worst of it. The proposal parade begins with only one suggestion for new revenue, emerging from modifying Pay/Go by compounding investment income within Health Savings Accounts. Because the sums are large, several following chapters explore pitfalls, safeguards, and accommodations. Following that, come a dozen proposals for cost reduction. Waste is unfortunately also abundant, and must be cut. However, it is generally less useful to hunt down villains because, after the struggle is over, we must live with each other.

Originally published: Saturday, April 20, 2013; most-recently modified: Thursday, May 09, 2019