Related Topics

Personal Finance

The rules of financial health are simple, but remarkably hard to follow. Be frugal in order to save, use your savings to buy the whole market not parts of it, if this system ain't broke, don't fix it. And don't underestimate your longevity.

Dislocations: Financial and Fundamental

The crash of 2007 was more than a bank panic. Thirty years of excessive borrowing had reached a point where something was certain to topple it. Alan Greenspan deplored "irrational exuberance" in 1996, but only in 2007 did everybody try to get out the door at the same time. The crash announced the switch to deleveraging, it did not cause it.

...Trying Out the New Constitution

George Washington's first term as President was much like a continuation of the Constitutional Convention, with many of the same participants.

Whither, Federal Reserve? (2)After Our Crash

Whither, Federal Reserve? (2)

Shaping the Constitution in Philadelphia

After Independence, the weakness of the Federal government dismayed a band of ardent patriots, so under Washington's leadership a stronger Constitution was written. Almost immediately, comrades discovered they had wanted the same thing for different reasons, so during the formative period they struggled to reshape future directions . Moving the Capitol from Philadelphia to the Potomac proved curiously central to all this.

Robert Morris and America

Robert Morris was an energetic problem-solver. In solving those problems he devised some innovative solutions which have become such axiomatic principles of a republic and its economics, that his name is seldom associated with them.

Right Angle Club 2012

This ends the ninetieth year for the club operating under the name of the Right Angle Club of Philadelphia. Before that, and for an unknown period, it was known as the Philadelphia Chapter of the Exchange Club.

..Tax and Fiscal Issues in the Constitution, Morris (1)

For some founding fathers, monetary issues were all that mattered.

Morris Defends Banks From the Bank-Haters

|

| Robert Morris |

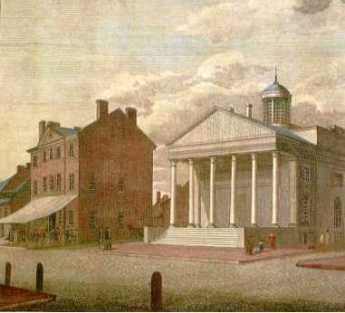

IN 1783 the Revolution was over, in 1787 the Constitution was written, but the new nation would not launch its new system of government until 1790. It was a fragile time and a chaotic one. Earlier, just after the British abandoned their wartime occupation of Philadelphia in 1778, Robert Morris had been given emergency economic powers in the national government, whereas the state legislatures were struggling to create their own models of governance, often in overlapping areas. While the Pennsylvania Legislature was still occupying the Pennsylvania State House (now called Independence Hall) in 1778, it -- the state legislature -- issued the charter for America's first true bank the Bank of North America, and in 1784 the charter came up for its first post-war renewal. Morris was a member of the Pennsylvania Assembly both times. Although he was not a notable orator, it was said of him that he seldom lost an argument he seriously wanted to win. Keeping that up for several years in a small closed room will, unfortunately, make you many enemies.

|

| Tavern and Bank |

Morris was deeply invested in the bank, in many senses. He had watched with dismay as the Legislature squandered and mismanaged the meager funds of the rebellion, issuing promissory notes with abandon and no clear sense of how to repay them, or how to match revenues with expenditures. There was rioting in the streets of Philadelphia, very nearly extinguishing the lives of Morris and other leaders, just a block from City Tavern. Inflation immediately followed, resulting in high prices and shortages as the farmers refused to accept the flimsy currency under terms of price controls. Every possible rule of careful management was ignored and promptly matched with a vivid example of what results to expect next. Acting only on his gut instincts, Robert Morris stepped forward and offered to create a private currency, backed by his personal guarantee that the Morris notes would be paid. The crisis abated somewhat, giving Morris time to devise The Pennsylvania Bank, and then after some revision the first modern bank, the Bank of North America. The BNA sold stock to some wealthy backers of which Marris himself was the largest investor, to act as last-resort capital. It then started taking deposits, making loans, and acting as a modern bank. Without making much of a point of it at the time, the Bank interjected a vital change in the rules. Instead of Congress issuing the loans and setting the interest rates as it pleased, a commercial bank of this sort confines its loans to a fraction or multiple of its deposits, and its interest rates are then set by the public through the operation of supply and demand. The difference between what the Legislatures had been doing and what a commercial bank does, lies in who sets the interest rates and who limits the loans. The Legislature had been acting as if it had the divine right of Kings; the new system treated the government like any other borrower. As it turned out, the government didn't like the new system and has never liked it since then. Today, the present system has evolved a complicated apparatus at its top called the Open Market Committee of the Federal Reserve, most of whose members are politically appointed. Several members of the House Banking Committee are even now quite vocal in their C-span denunciations of the seven members of the Open Market Committee who in rotation are elected by the commercial banks of their regions. Close your eyes and the scene becomes the same; agents of the government feel they have a right to control the rules for government borrowing, while agents of the marketplace remain certain governments will always cheat if you don't stop them. This situation has not changed in two hundred years and essentially explains why some people hate banks.

|

| Seigniorage |

That's the real essence of Morris's new idea of a bank; other advantages appeared as it operated. The law of large numbers smooths out the volatility of deposits and permits long-term loans based on short term deposits. Long-term deposits command higher loan prices than short-term ones can; higher profits result for the bank. And a highly counter-intuitive fact emerges, that making a loan effectively creates money; both the depositor and the borrower consider they own it at the same time. And finally, there is what is called seigniorage. Paper money (gold and silver "certificates") deteriorates and gets lost; the gold or silver backing it remains safe in the bank's vault, where it can be used a second time, or even many times.

For four days, Morris stood as a witness, hammering these truisms on the witless Western Pennsylvania legislators. At the end of it, scarcely one of them changed his vote, and the bank's charter was lost. But at the next election, the Federalists were swept back into the majority, defeating the opponents of the bank. Although, as we learn the way democracy works, still leaving them unconvinced of what they do not want to believe.

Originally published: Tuesday, November 01, 2011; most-recently modified: Sunday, July 21, 2019