Related Topics

...Trying Out the New Constitution

George Washington's first term as President was much like a continuation of the Constitutional Convention, with many of the same participants.

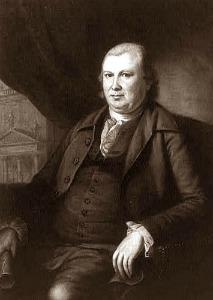

Robert Morris: Think Big

Robert Morris wasn't born rich, or especially poor, but he was probably illegitimate. He had no recollection of his mother; his father, a tobacco trader in England, emigrated to Maryland and died rather young. It didn't take long for young Robert to become one of the richest men in America.

..Tax and Fiscal Issues in the Constitution, Morris (1)

For some founding fathers, monetary issues were all that mattered.

Robert Morris, Financial Virtuoso

For reader convenience, we here divide Robert Morris' financial rescue of wartime America into two parts before and after 1780, because he had two episodes of being officially in charge. The first immediately followed the Battle of Fort Wilson when chaos and worthless paper money required a strong hand; it will be described next. The second episode followed the later near-revolt of the Continental Army but has already been outlined. Here, Morris was recalled to the office with chaos erupting at the end of the war came in sight and everyone was reluctant to fight battles for no military purpose. At the same time British, French and American politicians connived for victory in a war each had failed to win militarily. For simplicity, time sequences have been distorted a bit, concentrating the creation of modern banking into the second episode, where failure to coordinate banking with taxation ultimately led to the Constitutional Convention in 1787. Chronology has been sacrificed to enhance clarity. It is now time to return to the brilliant expedients Morris employed after he took charge following the Fort Wilson shocker, omitting some of the banking details already described.

What helped the first crisis most was the ready availability of a financial genius to turn around a crisis, when just about everyone else was at a total loss. Robert Morris had made his fortune, probably the richest man on the continent, and nursed the grievance of crowd abuse at the Battle of Fort Wilson. He had some novel concepts to test; it is not too much to say he showed them off, particularly since they displayed a man in charge with prodigious energy, applying a financial virtuosity of seemingly unlimited ideas. No one else came close to Morris in stature, and he must be forgiven for flaunting it a little.

|

| Robert Morris |

At the climactic moment, however, Morris played coy. He was not so sure he would accept the office of Financier, a term newly invented for the occasion. Accepting Ben Franklin's cynical assessment of the future, he wanted everyone to be clear: he was not going to give up his private partnerships. And he insisted on his right to hire and fire anyone at all within the government bureaucracy who was concerned with public money. He accepted responsibility for new debts of the government, but not for old debts incurred before he took office. He would furthermore delay taking the oath of office for a few months. These conditions naturally generated wild opposition in Congress; Morris was serene, and Congress finally had to agree. Most of these terms had some obvious purpose while making no secret of his distrust of Congressmen. In fact, the opposition might well have hardened its position if the purpose of delaying the oath had been fully expressed. Morris wanted to delay becoming a federal officer in order to delay resigning from the Pennsylvania Assembly. During the interval, he applied similar power tactics to the Legislature, ending up simultaneously in charge of both state finances and federal.

|

| Yorktown: Oct. 19, 1781 |

That purpose was soon to emerge, as just one instance of many tough tactics. Inflation tossed and turned the finances of everyone, so Morris would buy with one currency and sell with another, taking advantage of brief fluctuations, then quickly reverse the currency transaction when advantages shifted. He arranged with the French and Spanish ministers to keep their loans and foreign aid in separate accounts, applied the same techniques with state accounts, and even between near and distant counties within Pennsylvania. He thus had a choice between many currency values at any one moment. His far-flung commercial network supplied him with more precise information than his counterparties could get, and usually more quickly, so his trading activities were usually profitable. One rather extreme example was the arrangement with Benjamin Franklin in Paris; Morris would write checks to Franklin in one currency and Franklin would write identical deposits back to him on the same day but a different currency. He thus extended ancient practices among international merchants, carrying them over to government operations, which had the effect of creating a modern currency exchange. To outsiders, however, particularly his political enemies in Massachusetts and Virginia, it looked fishy. To modern observers, the astonishing thing was his ability to keep such complexity in his head. The political class which even today sees it as natural that governments might want to manipulate currency as they please might describe Morris strategies as dubious. Those who believe the market price is usually the true price however, must applaud this strategy for forcing manipulated prices back to market levels. Since here has rested the central dispute in American politics for two centuries, Morris must be credited with inventing even that dispute. One would normally suppose that doubling the silver price of American currency in two months would vindicate his trading strategy; but it has not always done so, suggesting the nature of the questioning has been more ideological than economic.

Within days of assuming office, the "legal tender" laws were repealed, stripping government of the ability to force its citizens to accept the worthless currency, impose rationing and price controls, and otherwise assume the mantel of "sovereignty". Like a miracle, food began to reappear in the Philadelphia marketplace at a lower price, and confidence in the competence of government began to return. To whatever degree the British ministry had been deliberately stalling the peace talks in the hope of American collapse, this incentive was dissipated.

The list of financial innovations which Morris produced in a remarkably short time, is seemingly endless. He next became central in the creation of the first American bank of the modern sort, the Bank of North America. And somewhere in that welter of activity appears to be the recognition of the so-called yield curve. Loans for a few weeks or months command a much lower interest rate than long-term loans; in the colonial period, almost all loans were for six months or less. Morris seems to have realized early that great profitability could be achieved by merging a sequence of several short loans into one long one. He thus devised a number of strategies which had the general effect of linking short loans together. Using the remittance for a transatlantic cargo in one direction as payment for the return cargo on the same ship was an early example. Once you grasped the idea and did it deliberately, long sequences of linked loans began to suggest themselves. Just to complete the thought, it might be noticed that present-day globalization reverses the process, with shorter-term loans for components substituting for longer-term loans for the entire assembled product. With lower interest rates, competitive prices can be reduced, unless a choice is made to increase profits.

There's one last issue in Robert Morris folklore: Did he finance the whole Revolution out of his own pocket? The answer is surely no because Beaumarchais ended up spending much more than any other individual, however involuntarily. The degree to which hard currency originated with the French, Spanish and American governments is a little unclear, and war damages are impossible to appraise. There were moments when Morris did personally finance major cash shortages, adding the considerable advantage of speeding up what could be a cumbersome process of budgeting, committee consideration, disputes, and hesitation. Where it was feasible, he sought restitution. Every bureaucrat has experienced delays and obstructions he dreams of eliminating by simply paying for it himself; Morris had the advantage that within reason, he could afford it.

As a very rich man, his more important personal contribution was his pledge to make good if the Treasury defaulted. Creditors generally preferred his credit to that of the government; his pledge was to pay if the government could not. His "Morris Notes" were not paying, but rather reinsuring government debts, in modern terms offering a Credit Default Swap. If we lost the war and our debts defaulted, Morris would have lost everything he had. But short of that, his pledge would result in much smaller losses. The public couldn't be expected to understand all that, so some simplified explanations were understandable. There were probably a number of similar examples, but near the end of the war, there was a particularly clear one. The Continental Army was very close to revolt when it looked as though Congress would disband the soldiers without paying them; there was no money but unpaid demobilization would likely send rioting soldiers through the countryside. Morris came forward with a million dollars of his own money and saved the day. Washington was forced to make emotional speeches appealing to the patriotism of the troops, but with most of the army barefoot, that was not certain to hold them back. Under those circumstances, to come forward later like Arthur Lee and remind everyone that Morris had once refused to sign the Declaration of Independence, was ingratitude of the meanest sort.

The accusation made after the war was that he profited from government losses, but there has never been evidence of that. His position was that he came out about even. Unspoken in these quarrels was the plain fact that until he got involved in the post-war real estate boom, he didn't need to cheat. Probably didn't even have time for it.

The Revolutionary War continued for two years after Morris took office for the second time, so war losses continued in spite of improved financial management. Both the French Government and the American one were at the edge of bankruptcy. Britain was also in political chaos, but it was only small consolation that Parliament had granted Independence to the Colonies when King George III remained adamant that it wasn't going to happen to his colonies. Strengthened by the British defeat of the French Caribbean fleet, the capitulation by the Spanish about Gibraltar, and great uncertainty about the Crimea and India -- almost anything was possible. Eventually, matters began deteriorating again. The British even then had the financial strength to hold out much longer, but obvious neglect of other opportunities eventually wore them down. Morris seemed to be winning, just by not losing.

In the midst of such anarchy, Morris had to admit his greatest failure as the Financier but was already formulating his plan for setting things on their feet. The Revolutionary War as seen by a financier had either been won by the British system of taxation or else lost by the American and French lack of such a system. It was irrelevant whether the War was described as a defeat for Britain or a victory for America; in Morris' view, the British had a good system and we had a poor one. No nation can finance a major war out of current receipts; you have to borrow. Your security for loans is the economy of your nation. Even if your illiquid assets are adequate for the war, the banking markets regard your ability to pay cash for the interest on the loan as their only reliable test of your solvency. That is, a nation at war must have the ability to keep the bankers happy with regular interest payments. For that, a nation had to have a proven system of reliable taxation. Britain had it, and the American/French alliance didn't. Franklin's masterful diplomacy was just lucky enough to achieve generous terms, but that wasn't good enough, we had to have a Federal tax system to survive and thrive. And to achieve that, we had to have a new Constitution. Never mind that resentment about British taxes got us into this mess. Never mind the chaos attending the Treaty of Paris. Never mind the war-weariness, bitterness, and destitution of the troops. Never mind that Morris was now about to embark on one of the most mind-boggling real estate ventures in history, was going to go to debtor's prison, was going to engage in millions and millions of dollars of borrowing and restitution. Never mind. We needed a new Constitution, and we were going to get it. Think big.

Originally published: Friday, July 22, 2011; most-recently modified: Wednesday, June 05, 2019