Related Topics

Philadelphia Economics

economics

Globalizing Real Estate

|

| U.S. Treasury bonds |

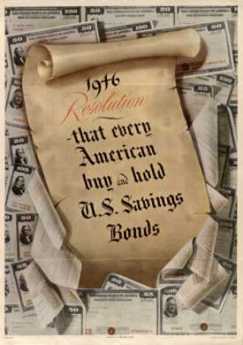

As the whole world evolves from an agricultural economy to something else we call modern, one country after another finds wealth accumulating faster than its rudimentary banking system can handle. Until the banking system matures, the result is usually severe inflation in the price of real estate. For an easy illustration, pick up one of those Nineteenth-Century Russian novels, replete with the familiar figure of a rich Russian nobleman who owns vast estates, losing it all for lack of ready cash. In our century, the illustration would be the whole Chinese populace, forced by lack of alternatives to buy U.S. Treasury bonds which almost every American shoeshine boy will tell you are a weak investment.

A modernizing economy doesn't have to rely on real estate alone; gold and precious gems partially serve the role of a banking system and help define the limitations of its absence. Like real estate, gems and gold coins must be protected from physical theft and attrition, while at the same time lack any means of generating income. Herein lies the explanation for jumps in real estate prices in places where oil is discovered, like Kazakhstan.

The recent rise in real estate prices in America, from which Philadelphia does not escape, is related but different. Here, our unique tax exemption for interest on home mortgages plays a role, augmenting the main issue which is artificially low interest rates. Interest rates in America are suppressed by a flood of wealth from the Far East, especially Japan and China. Since this phenomenon results from backing-up behind impaired banking systems, the Orientals are exporting their problem to us because they lack other alternatives. Since they simultaneously export deflation from their low prevailing wages, the world economy is in a precarious balance between two pressures which are someday almost certain to get out of balance. The textbook solution for this issue is for banking systems to spread and mature in the Far East, a process requiring at least another decade and to some degree another century.

But banking itself is changing and changing too fast to manage. Banks as Americans know them are fast disappearing, replaced by credit cards, money market funds, electronic bill-pay, and deliberately impenetrable mysteries like hedge funds and derivatives. This is a great time to have an advanced degree in mathematics, but the main problem is that vast wealth is to be made from keeping others from knowing what you are doing. If your faith is in a regulatory solution, just watch Congressional hearings on C-Span. Politicians always look puzzled when confronted with economics. When the topic is monetary aggregates, their woeful expressions only evoke pity.Originally published: Thursday, May 24, 2007; most-recently modified: Tuesday, May 21, 2019